Gawd I am tired of the pile of slick sheets in my mailbox!

These mailers are touchable evidence about how much money is being spent on elections. The local assembly candidates are spending enough money to fund a research initiative to end cancer. The real estate industry is pumping money into the No on G (25% transfer tax) campaign, and the soft drink manufacturers are sweetening printers income with a blizzard of No on E (the soda tax) four-color cards.

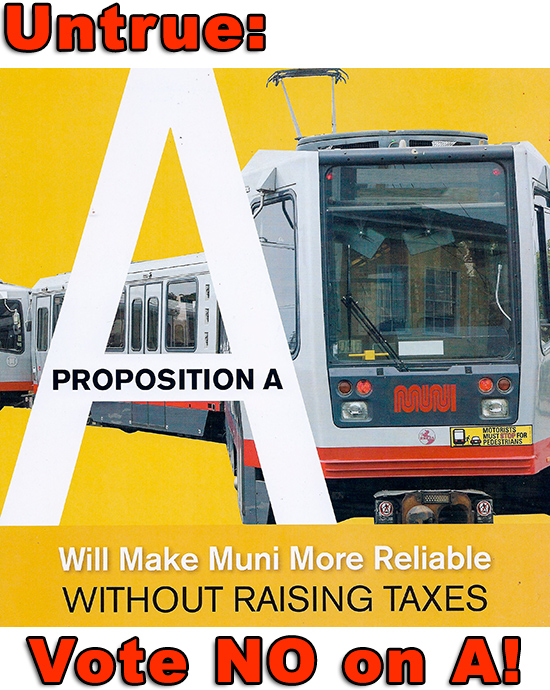

The flier that caught my eye yesterday was the one that validates my opposition to Prop A, the “fix MUNI” bond issue. As I posted before (see Stop Robbing MUNI and $500 Million for Bike Lanes. $0 for MUNI), the bond doesn’t allocate any money for MUNI. MUNI is one of a list of possible recipients of the bond money. Other claimants on the bond money are bike lanes, street-narrowing projects, and other politically charged — but non-MUNI — initiatives.

But, beyond the truth-bending assertion Prop A will make MUNI more reliable is the absolutely untrue statement that the MUNI magic will be done “without raising taxes”.

- Prop A requires a 66 1/3% affirmative vote to pass. That super-majority is required by state law for tax increases. If Prop A did not increase taxes, it would only require a simple majority.

- The City Controller’s Statement on Prop A in the official ballot book says, “… the highest estimated annual property tax cost for these bonds for the owner of a home with an assessed value of $500,00 would be approximately $91.02.” A $90 a year tax increase sounds like “raising taxes” to me.

Just because a statement is printed (or on the Internet) doesn’t make it true. Vote NO on A!

Leave A Comment